Introduction:

Are you contemplating selling your business? If so, don’t get caught in the trap that so many entrepreneurs fall into when they sell a business. 48% of business owners have no exit strategy in place. My team and I have seen countless entrepreneurs leave money on the table by not properly preparing for their businesses to sell.

Whether you're planning to retire, pursue new ventures, or simply cash out on your hard work, selling a business is one of the most significant decisions you'll ever make. In this comprehensive guide, I'll explain everything you need to know to successfully sell a business and maximize its value!

Preparing To Sell a Business

Let me tell you something my team and I have learned the hard way over several years of buying and selling businesses. Preparation is essential when it comes to selling your business.

Million-dollar deals fall apart simply because owners aren't ready for the scrutiny that comes when they sell their business. However, much of the pain and suffering that often occurs can be avoided by following five basic sell-a-business steps. They are:

1. Getting Your Financial House in Order

- Ensure at least 3 years of clean, professionally reviewed financial statements are available for review.

- Separate personal and business expenses (this is huge - buyers hate seeing these mixed).

- Create clear documentation of all recurring revenue streams.

- Maintain detailed cash flow projections.

- Keep organized tax returns and supporting documents.

Ideally, organizing financial records to sell a business should start at least a year before one plans to sell. This may appear to be a long time, but our experience shows financial records for most small businesses take longer than the business seller contemplates.

2. Streamlining the Sell-a-Business Process

One of the biggest value-killers of selling a business is when the business relies too heavily on internal knowledge of the everyday actions and processes used to make the business successful.

The problem occurs when there is no standardized written system or format that explains or demonstrates the system that produces the success. The business should document everything! Here's what needs attention:

- Standard Operating Procedures (SOPs) for all key processes

- Employee roles and responsibilities are clearly defined

- Technology systems and software documented

- Vendor relationships and contracts organized

- Customer service protocols standardized

Our experience working with numerous businesses helping them to scale up and prepare for the sale of their businesses shows that sales prices can be increased by twenty percent (20%) or more by spending time documenting and optimizing their processes. The key is making your business as turnkey as possible.

3. Understanding Your Key Metrics

This part is crucial. Buyers today are incredibly sophisticated about data. They don't just want to know your revenue and profit, they want to understand the health of your business at a granular level.

Focus on these metrics:

- Customer Acquisition Cost (CAC)

- Lifetime Value (LTV)

- Churn rate (especially important for subscription businesses)

- Gross and net profit margins by product/service line

- Employee productivity metrics

- Market share and growth rates

4. Reducing Owner Dependency

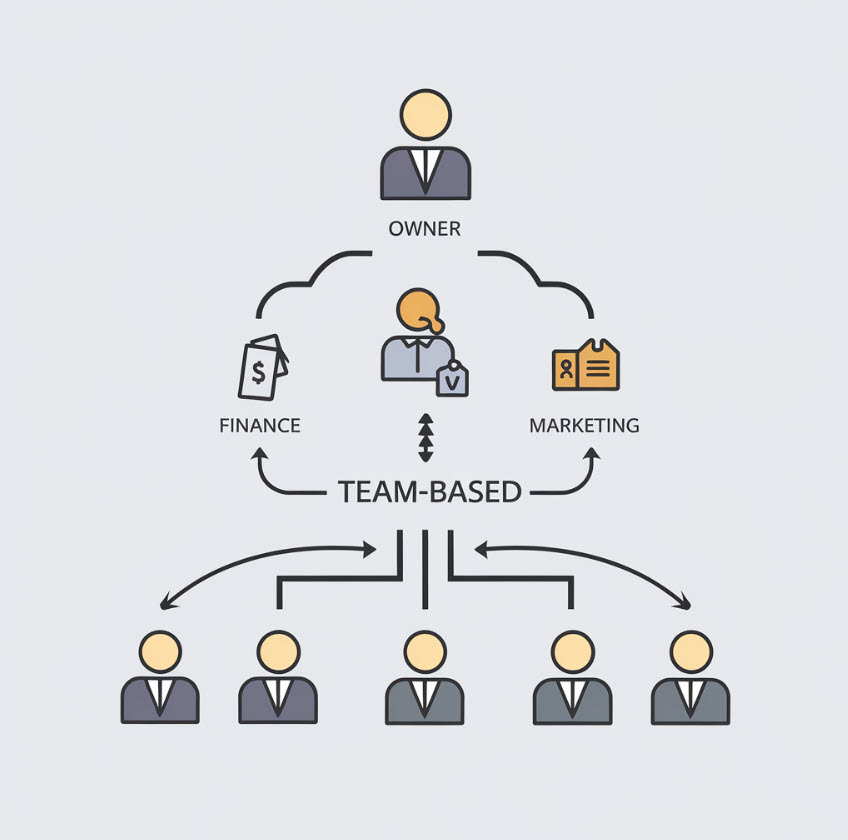

Getting to a point where your business can run without you is crucial for maximizing its sales potential. If your business can't run without you, it's going to be worth significantly less to buyers. The best position is to have a team-based business. The graphic below provides a picture of what a business operation should look like for the best sales position and exit strategy.

Here's your action plan:

- Delegate key client relationships to your team

- Document your intellectual property and unique processes

- Build a strong management team

- Create systems for decision-making that don't require owner input

- Establish clear succession plans for key roles

5. Crafting Your Growth Story

Every successful business sale I've been involved with had one thing in common - a compelling narrative about future growth. This isn't about making things up, it's about clearly articulating the opportunities that exist for the right buyer. Consider including:

- Market analysis showing untapped potential

- Specific growth opportunities you haven't had time/resources to pursue

- Competitive advantages that could be better leveraged

- Strategic partnerships that could be expanded

- New products or services in development

While I can't verify current market statistics, I recommend checking resources like BizBuySell's Insight Report and the International Business Brokers Association (IBBA) for the latest market data and trends.

Remember, preparing your business for sale is a marathon, not a sprint. A good rule of thumb is to start this process at least 18-24 months before listing the business for sale. The effort put in during this phase will directly impact both your sale price and how smoothly the transaction goes.

Determining Your Business's Value

Our business acquisition and sales team have over two decades of valuing businesses. In that time the consensus of the experience shows that pricing a business is both an art and a science. There are several factors involved in the valuation of a business.

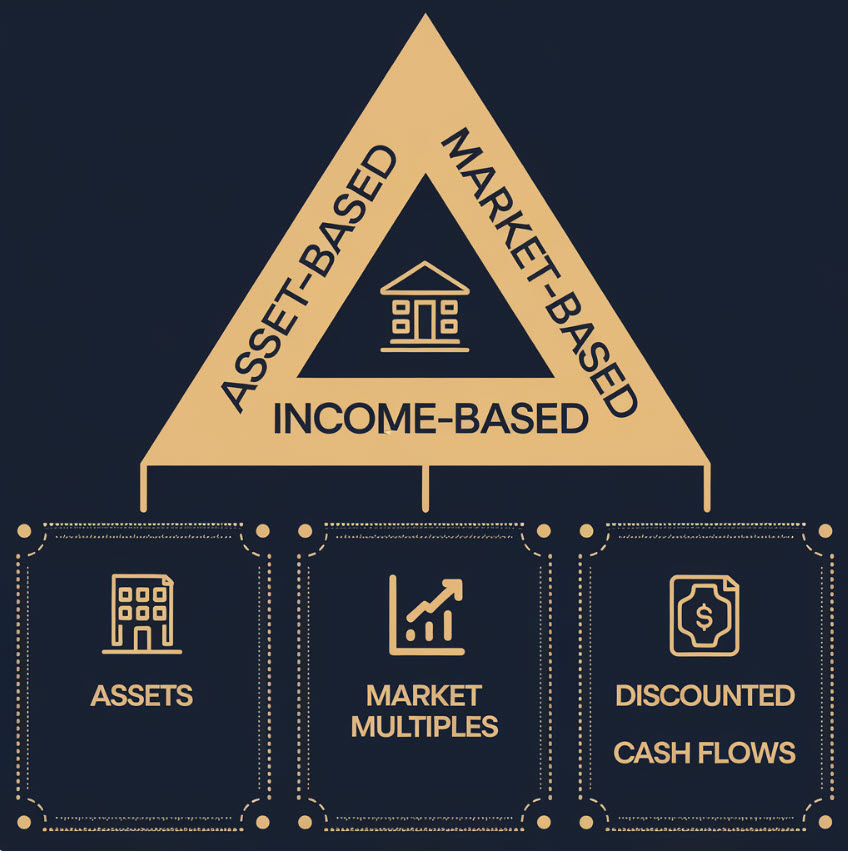

Understanding Different Valuation Methods

The key to a realistic valuation is using multiple methods. Here's how each one works:

Asset-Based Approach:

- Book value calculation (assets minus liabilities)

- Adjusted book value (market value adjustments)

- Liquidation value (worst-case scenario)

- Replacement value consideration

Market-Based Approach:

- Industry multipliers (specific to your sector)

- Comparable sales analysis

- Rule of thumb calculations

- Market condition adjustments

Income-Based Approach:

- Discounted cash flow analysis

- Capitalization of earnings

- Seller's discretionary earnings (SDE) multiple

- EBITDA (Earnings Before Interest Taxes, Depreciation, and Amortization) multiple analysis

Industry-Specific Considerations

Valuation multipliers vary wildly by industry. A SaaS (Software as a Service) company may sell for 8x EBITDA while a retail business in the same price range may sell for 2.5x EBITDA. Here's what impacts these differences:

- Scalability potential

- Intellectual property value

- Customer concentration risk

- Market growth rate

- Regulatory environment

- Competition level

Always research recent sales in your specific industry. Sources like GF Data and DealStats (formerly Pratt's Stats) provide valuable comparison data.

The Impact of Intangible Assets

Here's something many business owners overlook - intangible assets- which often represent the majority of a business's value. Key intangible assets include:

- Brand reputation and recognition

- Customer relationships and contracts

- Proprietary technology or processes

- Patents, trademarks, and copyrights

- Trained workforce and culture

- Strategic partnerships

- Geographic advantage

All of the above should be given careful consideration and a valuation as part of the overall sales process of any business.

To Sell a Business Don't Overlook Cashflow

Many valuations go wrong because of a lack of valuating cash flow of the business that is being sold. While revenue is important, cash flow is king. Here's what buyers actually care about:

- Consistent monthly cash flow trends

- Working capital requirements

- Seasonal fluctuations

- Customer payment terms

- Vendor payment requirements

- Capital expenditure needs

A business that has strong revenue but poor cash flow management will be valued much less than one that has good cash flow mangement. By implementing better collection procedures and inventory management, a business can increased its valuation by 25% in as little as six months.

Common Valuation Mistakes to Avoid

Here is a list of common valution mistakes we have seen repeatedly over the years of our experience:

1. Overvaluing emotional attachment

- Your years of hard work don't directly translate to value

- Focus on objective measures

2. Ignoring industry trends

- Rising/declining sectors affect multipliers

- Technology disruption impacts

3. Poor add-back analysis

- Missing legitimate add-backs

- Including inappropriate personal expenses

4. Overlooking working capital

- Not calculating normal working capital needs

- Failing to adjust for seasonal variations

5. Insufficient market research

- Not considering local market conditions

- Ignoring broader economic factors

Documentation and Support

Remember this golden rule: any value you claim must be documented and defendable. Create a detailed valuation support document including:

- Three years of adjusted financial statements

- List of all included assets and liabilities

- Analysis of add-backs with documentation

- Market research and comparable sales

- Growth projections with supporting data

- Risk assessment and mitigation strategies

Note: While I draw from extensive experience, I recommend consulting with certified business appraisers for formal valuations. Organizations like the American Society of Appraisers (ASA) and the International Business Brokers Association (IBBA), previously mentioned above, maintain directories of qualified professionals.

Finding Qualified Buyers To Sell a Business To

Our team has either sold or assisted in hundreds of business acquisitions and sells of those businesses. Experience shows that finding the right buyer is often like finding a needle in a haystack. But here's the thing - it's not about finding any buyer, it's about finding the right buyer. Here's a process to shed some light on that process.

The Broker vs. DIY Decision

Making the decision to hire a professional broker to represent the seller of a business versus trying to sell the business alone can significantly impact the sale outcome. Let me break down both approaches:

Working with a Business Broker:

- Access to qualified buyer databases

- Confidentiality maintenance

- Professional marketing materials

- Negotiation expertise

- Market knowledge and pricing guidance

- Buffer between you and potential buyers

Selling Independently:

- Complete control over the process

- No commission fees

- Direct communication with buyers

- Flexibility in marketing approach

- Ability to adjust strategy quickly

- Greater involvement in screening

Here's an important point to keep in mind. If your business generates over $1 million in revenue, consider working with an M&A (Mergers and Acquisition) advisor rather than a traditional business broker. The expertise difference can be significant.

Creating an Effective Blind Profile to Sell a Business

A blind profile (a document used in the early stages of selling a business to a potential buyer that protects the seller's privacy) can be a key component of the sales process and is often the first thing a potential buyer sees. Done well it can increase the chances of attracting a serious and qualified buyer quickly.

Here's what a blind profile should include:

- Compelling business overview without revealing identity

- Key financial metrics and trends

- Market position and competitive advantages

- Growth opportunities

- Required buyer qualifications

- General location and industry

- Reason for sale (be honest but strategic)

Leveraging Online Marketplaces

Today's digital landscape offers numerous marketplace platforms for reaching potential buyers. Focus on these key platforms:

Premium Platforms:

- BizBuySell

- DealStream

- BusinessesForSale

- Axial (for larger deals)

Industry-Specific Marketplaces:

- Restaurants (for food service)

- PracticeLink (for medical practices)

- FranchiseResales (for franchises)

- TechBusinessForSale (for tech companies)

- Loopnet

Strategic vs. Financial Buyers

Understanding buyer types is crucial for targeting your marketing efforts:

Strategic Buyers:

- Competitors looking to expand

- Companies seeking vertical integration

- Businesses wanting geographic expansion

- Strategic acquirers seeking technology or talent

Financial Buyers:

- Private equity groups

- Family offices

- High-net-worth individuals

- Investment partnerships

Characteristics to look for in qualified buyers:

- Relevant industry experience

- Sufficient financial resources

- Clear acquisition strategy

- Professional approach to due diligence

- Strong management capabilities

- Cultural fit potential

Maintaining Confidentiality

This is absolutely critical - I've seen deals fall apart because of confidentiality breaches. Implement these protective measures:

1. Non-Disclosure Agreement (NDA) Process:

- Use a comprehensive, legally-reviewed NDA

- Have a system for tracking signed NDAs

- Include digital and physical information protection

- Specify non-solicitation terms

- Include non-compete clauses where appropriate

2. Information Release Stages:

- Stage 1: Blind profile only

- Stage 2: Basic financial overview

- Stage 3: Detailed financials and operations

- Stage 4: Customer and employee information

- Stage 5: Site visits and management meetings

3. Communication Protocols:

- Use secure data rooms

- Code names for the project

- Designated points of contact

- Scheduled information releases

- Documentation of all disclosures

Buyer Screening Best Practices

A framework to sell a business that matches buyers with sellers is very important. Here's a suggested best practice to follow:

Initial Screening Questions:

- Source of funds and proof of liquidity

- Previous business ownership/management experience

- Timeline for purchase

- Geographic preferences

- Size and type of business sought

Secondary Screening:

- Detailed background check

- Reference verification

- Financial capability documentation

- Management team assessment

- Strategic fit analysis

To sell a business I recommend consulting with legal and financial professionals for specific advice regarding any particular situation. Organizations like the Alliance of Merger & Acquisition Advisors (AM&AA) offer resources for finding qualified professionals.

Navigating Due Diligence To Sell a Business

Having guided numerous businesses through due diligence, we've seen this phase make or break deals on several occasions. Here's a secret - the best defense is a good offense. Let's look at how to prepare for and manage this critical phase of selling your business.

Essential Documentation Requirements

Think of due diligence like preparing for an audit on steroids. Here's your document checklist:

Financial Documentation:

- 3-5 years of tax returns

- Monthly financial statements (P&L, Balance Sheet)

- Cash flow statements

- Accounts receivable/payable aging reports

- Bank statements and reconciliations

- Equipment lists with valuations

- Inventory reports

- Debt schedules

Legal Documentation:

- Corporate formation documents

- Licenses and permits

- Insurance policies

- Employee agreements

- Customer contracts

- Vendor agreements

- Lease documents

- Intellectual property registrations

Operational Documentation:

- Employee handbooks and policies

- Operating procedures

- Quality control processes

- Safety protocols

- Training materials

- Organization charts

- Marketing materials

- Customer lists

Tip: Create a digital data room organized by category before you even list your business. It can save a huge amount of time in the due diligence process.

Managing Stakeholder Relationships

Maintaining confidentiality while preparing key stakeholders for potential changes is very important but can be challenging. Here's how to handle each group:

Employees:

- Identify key personnel for retention

- Develop communication timeline

- Create incentive plans for essential staff

- Prepare transition roles and responsibilities

- Document key employee knowledge

Customers:

- Review and document all relationships

- Identify concentration risks

- Prepare customer communication strategy

- Document service agreements

- Gather testimonials and references

Vendors:

- Review all supplier agreements

- Document pricing arrangements

- Identify critical supply relationships

- Prepare transfer requirements

- Assess alternative suppliers

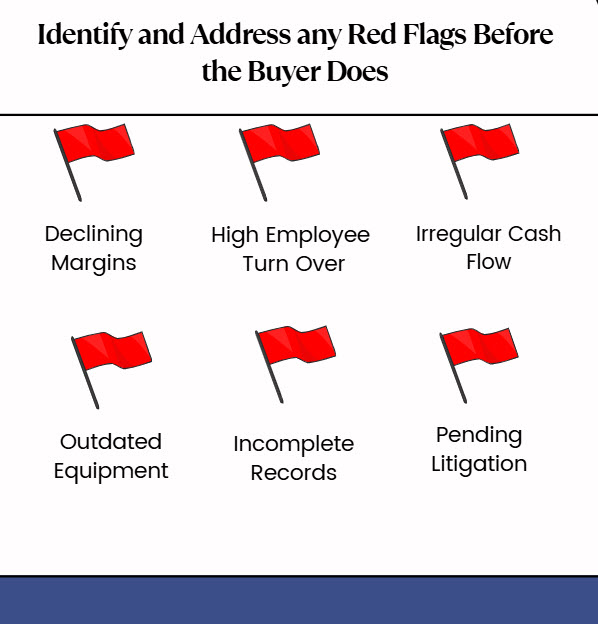

Addressing Red Flags Proactively

Every business has issues. The key is identifying and addressing them before the buyer does. Common red flags include:

Financial Red Flags:

- Customer concentration

- Declining margins

- Irregular cash flow

- High employee turnover

- Outdated equipment

- Incomplete records

Operational Red Flags:

- Owner dependency

- Undocumented processes

- Pending litigation

- Regulatory compliance issues

- Weak cybersecurity

- Environmental concerns

As a best practice, create a "Red Flag Memo" addressing potential concerns before they're raised. This shows transparency and professionalism.

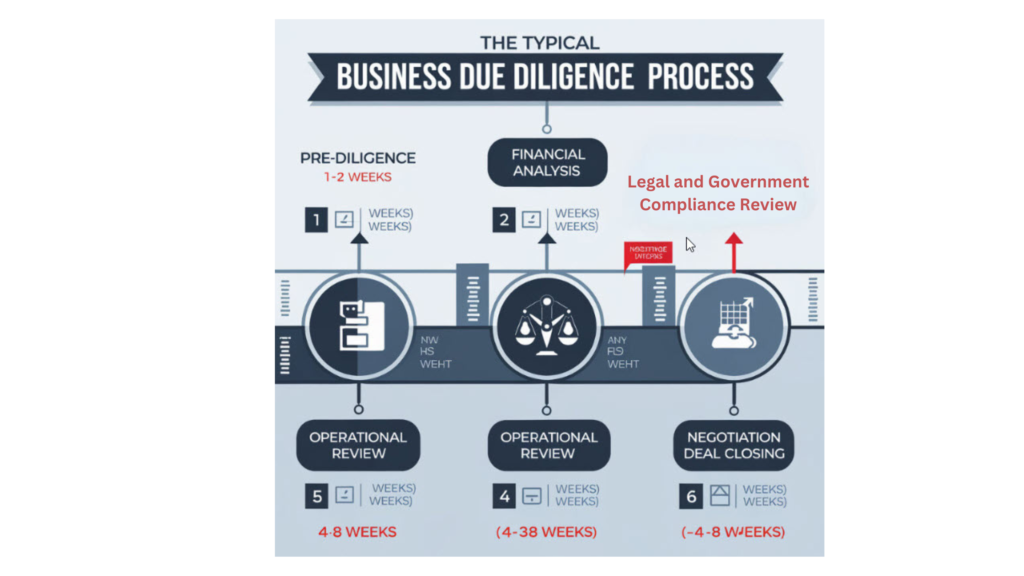

Timeline Management

Understanding typical timelines helps set realistic expectations follow these suggested timelines to make the business selling process as smooth as possible.

Preparation Phase (2-4 weeks):

- Document gathering

- Data room setup

- Team preparation

- Initial response planning

Active Due Diligence (6-12 weeks):

- Financial review

- Legal review

- Operational assessment

- Customer verification

- Employee interviews

- Site visits

Resolution Phase (2-4 weeks):

- Question responses

- Document updates

- Negotiation of findings

- Final verifications

The Importance of Working With Professional Advisors to Sell a Business.

Building the right team is crucial when selling a business. Here's who you need:

Core Team:

- M&A Attorney

- CPA or Tax Advisor

- Business Broker/M&A Advisor

- Financial Planner

- Insurance Advisor

- Specialized Support (as needed):

- Environmental Consultant

- IT Systems Auditor

- HR Consultant

- Industry Specialist

- Valuation Expert

Have weekly coordination calls with your advisory team to ensure everyone's aligned and moving forward efficiently.

Best Practices for Success

Here are key strategies our team has developed over years of managing due diligence:

1. Information Management:

- Use a secure virtual data room

- Track all document requests

- Maintain version control

- Create clear naming conventions

- Keep backup copies of everything

2. Communication Protocol:

- Single point of contact

- Regular status updates

- Question tracking system

- Response time standards

- Escalation procedures

3. Problem Resolution:

- Issues log maintenance

- Solution development process

- Negotiation strategy

- Documentation of resolutions

- Follow-up procedures

Note: Each deal is unique. Consider consulting with the International Business Brokers Association (IBBA) for additional resources.

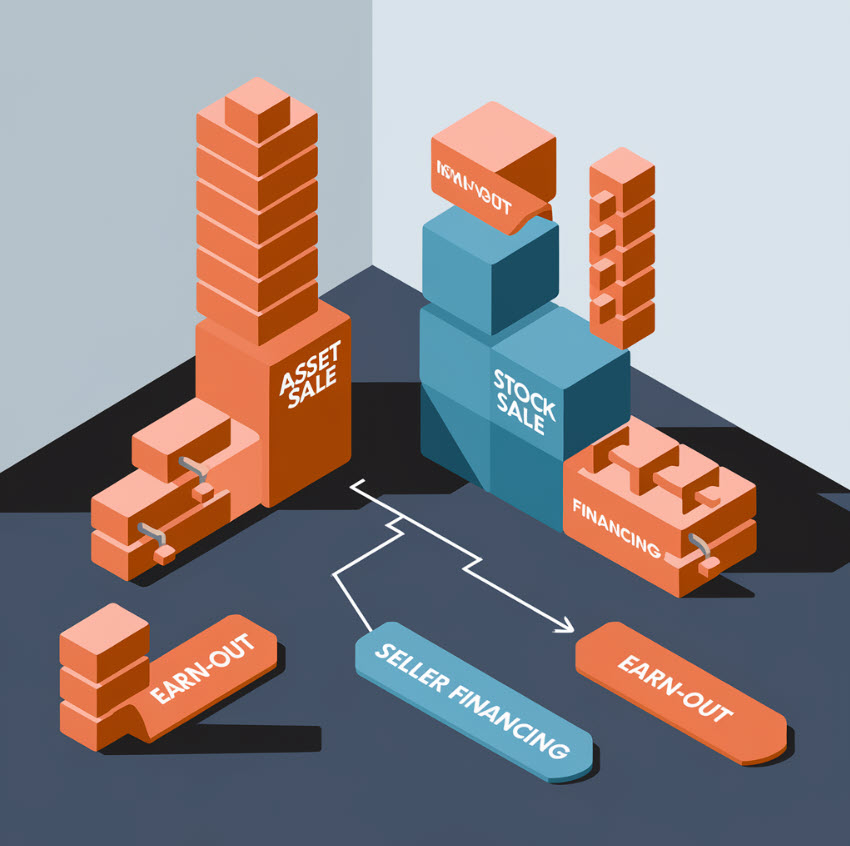

Deal Structure to Sell a Business

Throughout my career, I've learned that the way you structure a deal can be just as important as the purchase price. We have seen deals fall apart over structure issues that could have been resolved with proper planning. Follow the suggested steps below to help ensure the parties involved engage in a win-win deal structure that actually closes.

Common Deal Structures and Payment Term

The most common type of business buying deal structures are:

All-Cash Deals:

- Immediate full payment

- Clean break between parties

- Usually lower total value

- Rare in today's market

- Typically only for smaller deals

Seller Financing:

- 10-30% typical down payment

- 3-7 year payment terms

- Interest rates (typically 6-8%)

- Security arrangements

- Personal guarantees

Earn-Out Structures:

- Performance-based payments

- Defined metrics and timeframes

- Payment caps and floors

- Verification procedures

- Management agreements

Hybrid Structures:

- Combination of payment methods

- Risk-sharing arrangements

- Strategic partnerships

- Consulting agreements

- Stock/asset combinations

Tax Implications and Optimization

Proper tax planning can save you millions. Here's what you need to consider:

Asset Sale Considerations:

- Allocation of purchase price

- Depreciation recapture

- Capital gains treatment

- State tax implications

- Transfer tax issues

Stock Sale Benefits:

- Single level of taxation

- Preservation of tax attributes

- Simplified transfer process

- Continued contracts/licenses

- Employee benefit continuity

Tax Minimization Strategies:

- Installment sale treatment

- Charitable remainder trusts

- Opportunity zone investments

- 1031 exchange options

- Qualified small business stock

Work with a tax advisor who specializes in business sales. General CPAs often miss crucial opportunities for tax savings.

Asset vs. Stock Sale Detailed Analysis

Understanding the differences between an asset sale and stock sale is crucial for negotiation in selling a business. Read, study. and comprehend the following to ensure the best choice in completing the business sale.

Asset Sale Advantages:

- Buyer can depreciate assets

- Selective assumption of liabilities

- Clean break from past issues

- Flexibility in asset selection

- Easier due diligence

Stock Sale Advantages:

- Simpler transaction process

- Contract continuity

- License/permit retention

- Employee benefit continuation

- Better tax treatment for seller

Deal Points to Consider:

- Working capital adjustment

- Employee benefit transfers

- Contract assignments

- License transfers

- Warranty obligations

Negotiation Strategies and Common Pitfalls

Here's what I've learned about successful deal negotiations:

Key Negotiation Points:

1. Purchase Price Adjustments

- Working capital targets

- Inventory valuation

- Account receivable treatment

- Equipment condition

- Customer retention requirements

2. Risk Allocation

- Representations and warranties

- Indemnification provisions

- Escrow arrangements

- Personal guarantees

- Survival periods

3. Common Pitfalls to Avoid:

- Inadequate due diligence

- Unclear earn-out metrics

- Weak security provisions

- Unrealistic transition timing

- Incomplete tax planning

The Role of Earn-Outs and Seller Financing

Let me share some real-world insights on these crucial elements:

Effective Earn-Out Structures:

- Clear performance metrics

- Reasonable achievement targets

- Regular measurement periods

- Dispute resolution procedures

- Management control provisions

Seller Financing Considerations:

- Appropriate interest rates

- Security arrangements

- Payment schedules

- Default provisions

- Early payment options

Always include acceleration clauses in seller financing agreements and specific control requirements in earn-out arrangements.

Legal Documentation Requirements

Essential deal documents include:

Primary Agreements:

- Letter of Intent (LOI)

- Purchase Agreement

- Security Agreements

- Promissory Notes

- Employment/Consulting Agreements

Supporting Documents:

- Non-compete agreements

- Transition services agreements

- Real estate leases/transfers

- Intellectual property assignments

- Employee agreements

Note: While this guidance is based on extensive experience, I recommend working with experienced M&A attorneys for your specific situation. The Association for Corporate Growth (ACG) maintains a directory of qualified professionals.

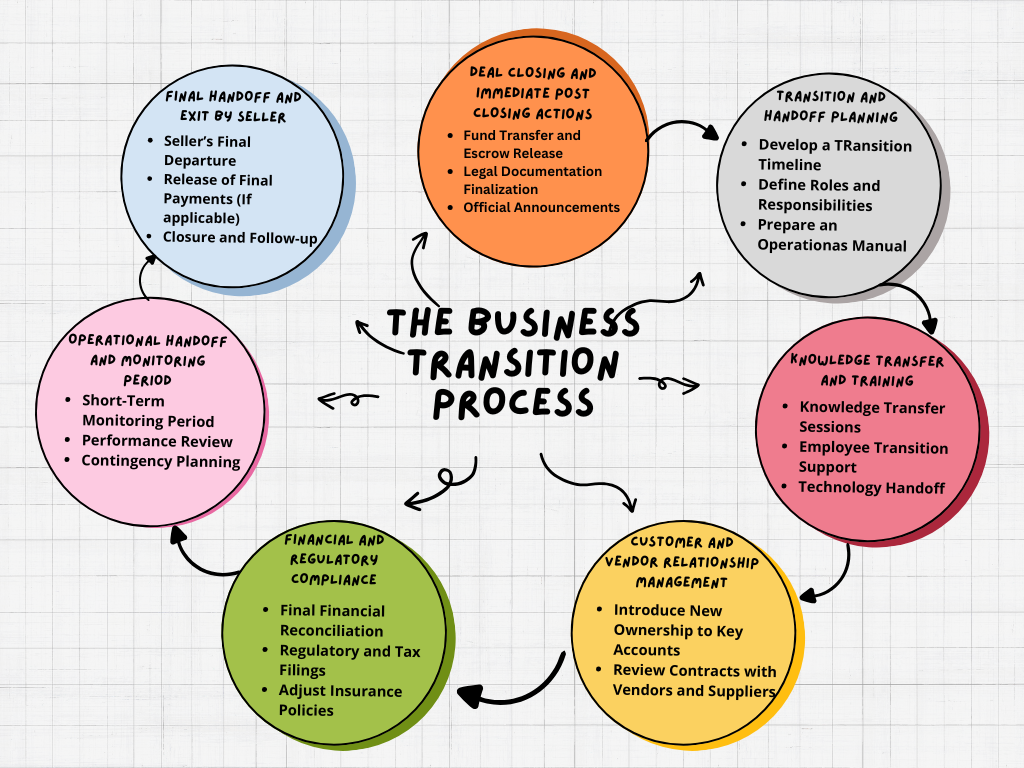

Ensuring a Successful Transition

Creating a Comprehensive Transition Plan

What happens after the sale is just as important as the sale itself. Many deals have soured and created an abundance of problems that could have been avoided through astute transition planning. Here are some tips to prevent most transition problems.

Your transition plan should be a living document. Here's what it needs to cover:

Operational Transition:

- Day 1 checklist

- First 30 days plan

- 90-day milestone targets

- 6-month integration goals

- 12-month success metrics

Key Areas to Address:

- Management responsibilities

- Financial controls

- Customer relationships

- Vendor relationships

- Employee roles

- Technology systems

- Quality control

- Compliance requirements

Knowledge Transfer Best Practices

This is where most transitions fail. Here's how to do it right:

Documentation Requirements:

- Standard Operating Procedures (SOPs)

- Process flow charts

- Customer relationship histories

- Vendor management guides

- Troubleshooting guides

- Employee training materials

Transfer Methods:

- One-on-one training sessions

- Group workshops

- Video recordings

- Written manuals

- Hands-on demonstrations

- Shadow periods

Timeline Management:

- Pre-closing preparation

- Immediate post-closing priorities

- Staged knowledge transfer

- Verification checkpoints

- Backup plans

Customer and Vendor Communication

Managing these relationships is crucial. Here's your strategy:

Customer Communication Plan:

- Timing of announcements

- Message development

- Contact person transitions

- Service continuity assurance

- Relationship maintenance strategies

Vendor Management:

- Contract reviews

- Payment terms transition

- Account transfers

- New point-of-contact setup

- Relationship maintenance

Key Messages to Convey:

- Business continuity

- Service level maintenance

- Enhanced capabilities

- Continued commitment

- Future growth plans

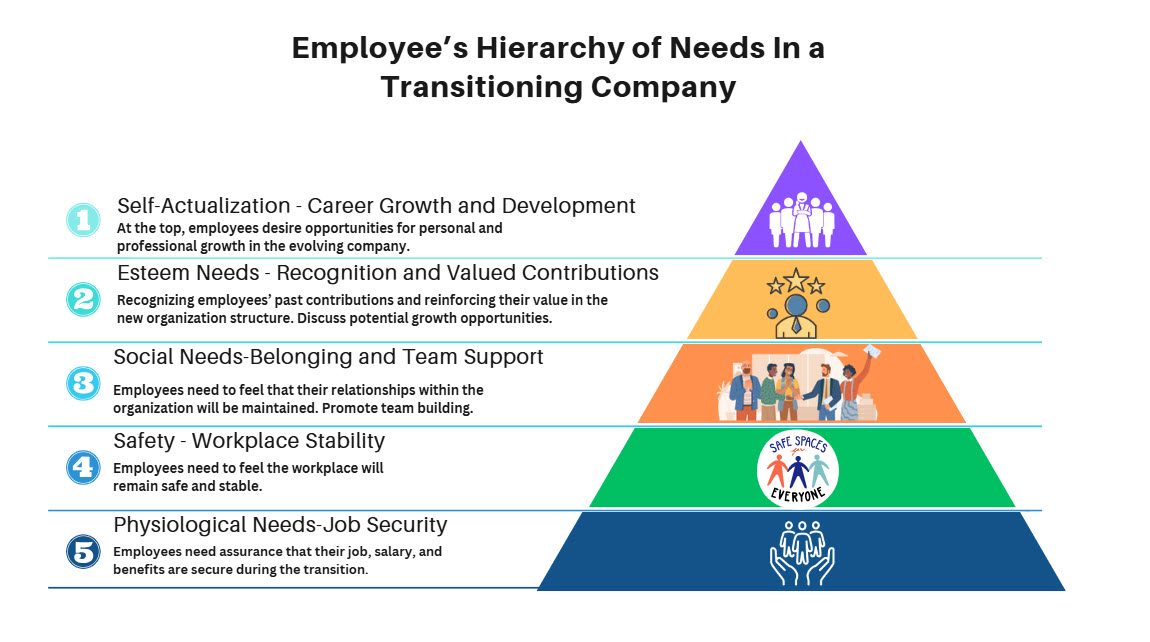

Employee Retention and Motivation

Keeping your team engaged is critical. Here's how:

Retention Strategies:

- Stay bonuses

- Clear career paths

- Role clarity

- Training opportunities

- Recognition programs

Communication Approach:

- Individual meetings

- Group announcements

- Regular updates

- Feedback sessions

- Progress reports

Risk Mitigation:

- Key employee agreements

- Non-compete clauses

- Confidentiality agreements

- Performance incentives

- Succession planning

Post-Sale Consulting Arrangements

Getting this right is crucial for both parties:

Consulting Agreement Elements:

- Duration (typically 6-24 months)

- Scope of services

- Time commitments

- Compensation structure

- Performance metrics

Common Arrangements:

1. Full-Time Transition (1-3 months):

- Daily involvement

- Direct management handoff

- Intensive training

- Relationship transfers

2. Part-Time Support (3-6 months):

- Weekly check-ins

- Project-based assistance

- Advisory role

- On-call availability

3. Advisory Role (6-24 months):

- Monthly meetings

- Strategic guidance

- Network introductions

- -Market insights

Include specific performance metrics and exit clauses in consulting agreements to protect both parties.

Measuring Transition Success

Track these key metrics:

Business Performance:

- Revenue retention

- Customer retention

- Employee retention

- Profit margins

- Growth rates

- Operational Metrics: Process adherence

- Quality standards

- Customer satisfaction

- Employee satisfaction

- System uptime

Integration Milestones:

- Knowledge transfer completion

- System integration

- Team integration

- Culture alignment

- Process optimization

Joining a professional organizations like the Exit Planning Institute (EPI) for additional resources and networking opportunities should be considered. Remember, a successful transition isn't just about maintaining the business - it's about positioning it for future growth.

The goal is to leave the new owner with a business that's even stronger than when you sold it.

Conclusion: Summary Roadmap to a Successful Business Sale

Selling a business is a journey, not an event. Let's recap the essential elements we've covered:

Key Section Summaries

**1. Preparing Your Business for Sale**

- Financial organization is foundational

- Documented processes increase value

- Reducing owner dependency is crucial

- Strong growth narrative matters

- Key metrics must be trackable

**2. Determining Your Business's Value**

- Multiple valuation methods needed

- Industry specifics heavily impact value

- Intangible assets often matter most

- Cash flow drives valuations

- Documentation supports value claims

**3. Finding Qualified Buyers**

- Broker vs. DIY decision is critical

- Blind profiles must intrigue but protect

- Strategic vs. financial buyers need different approaches

- Confidentiality is paramount

- Thorough buyer screening is essential

**4. Navigating Due Diligence**

- Preparation prevents problems

- Stakeholder management is crucial

- Red flags must be addressed proactively

- Timeline management matters

- Professional advisors are vital

**5. Structuring the Deal**

- Structure can be as important as price

- Tax implications need early planning

- Asset vs. stock sale differences matter

- Negotiation strategy is crucial

- Clear documentation prevents issues

**6. Ensuring a Successful Transition**

- Comprehensive transition planning required

- Knowledge transfer must be systematic

- Stakeholder communication is critical

- Employee retention needs focus

- Post-sale arrangements need clarity

Critical Success Factors

Based on successful exits, here are the most critical factors:

1. Early Preparation

- Start 18-24 months before intended sale

- Focus on systematic improvements

- Build a strong advisory team

2. Value Optimization

- Address weaknesses before marketing

- Document growth opportunities

- Strengthen competitive advantages

3. Process Management

- Maintain confidentiality throughout

- Keep multiple buyers engaged

Control information flow

4. Deal Execution

- Negotiate with multiple options

- Focus on win-win structures

- Plan for contingencies

5. Transition Excellence

- Over-communicate with stakeholders

- Exceed buyer expectations

- Leave a positive legacy

Final Thoughts and Next Steps

Remember these key points:

- The best time to start preparing is now

- Value is created well before the sale

- Professional help is an investment, not an expense

- Patience and preparation lead to premium prices

- A successful sale is about more than just money

Next Steps:

1. Assess your business's current state

2. Build your advisory team

3. Create a preparation timeline

4. Start documenting everything

5. Begin strengthening your management team

Each business sale is unique. Consider joining professional organizations like the Exit Planning Institute (EPI), International Business Brokers Association (IBBA), or M&A Source for ongoing education and resources.

The journey of selling your business might seem overwhelming, but taken step by step, it's entirely manageable. Remember, the effort you put into preparation will directly impact your final outcome.

As the saying goes, "The best time to plant a tree was 20 years ago. The second-best time is now." The same applies to preparing your business for sale.

Want To Grow and Scale Your Business Growth?

Discover how you can create a growth and scaleup strategy to boost your business's value 3x or more in six months or less?

Let us help you make it happen. My team and I have over 20 years experience advising small to medium sized businesses to get their valuation up to sell or just maintain for business operation purposes.

Find out how you can access this service and skyrocket your business without increasing costs that affect your profits. Call 855-494-6377 or book a call by clicking Calendar Call.

Join our list of satisfied customers and get periodic updates on:

Fill in the form and start receiving the secrets to building the business you've always wanted.